Is Robinhood App A Legitimate Stock Trading App

ALERT: Are you a U.S. citizen? If not, then you will unfortunately not be able to sign up for a Robinhood account. CLICK HERE TO LEARN ABOUT OUR #1 RECOMMENDED BROKER FOR NON-U.S. CUSTOMERS!

It is no secret that innovation in financial technology is having a major impact on the traditional financial services industry. Think about the many investment apps, savings apps, robo investing plans, budgeting apps, cryptocurrencies, and new online brokerages.

The leader in a lot of this innovation in the financial services industry is Robinhood. With over 10,000,000 users as of the end of 2020, many people are starting to ask the question 'is Robinhood safe?'

Robinhood has turned the investing world upside down. Just like Uber changed the way people use taxis, Robinhood has changed the way people invest. With Robinhood:

- you no longer need a $1,000 or more to open a brokerage account

- you no longer need to pay commissions

- you can now buy a half of a share or other fraction of you favorite stocks like Apple or Amazon or Netflix, and

- you will receive a free share of stock (up to $225) when you open an account; and you get more free stock when you refer your friends!

With these innovations in investing (especially being commission free and their referral program), Robinhood has quickly become the fastest-growing brokerage service in the United States.

But we're here to answer your questions about the overall safety of Robinhood. Is Robinhood legit? Is the Robinhood app safe?

Table of Contents:

- About Robinhood

- Why Choose Robinhood?

- Is Robinhood Safe to Use?

- The Financial Regulation of the Industry

- The Robinhood App Features

- How Does Robinhood Make Money?

- What Stocks Should I Buy?

About Robinhood's History

Founded by Baiju Bhatt and Vladimir Tenev, Robinhood has seen significant growth since its inception in 2013.

The concept was quite simple: Traditional brokerage firms were charging excessive commissions on every transaction and ripping off their customers.

The founders leveraged their experience on Wall Street, returned to Silicon Valley, raised some money and launched the first COMMISSION FREE, APP-BASED brokerage.They now have over 10 million users. That's proof positive of their product and their concept. And it also should tell you that Robinhood is safe.

In fact, Robinhood recently surpassed one of the most well-known brokerages, E*Trade, in terms of the number of active accounts.

But their explosive success begs the question:is Robinhood safe?What are the risks involved with Robinhood?

You will find the answers to all of this and more in this Robinhood Review. Simply read on…

Why Choose Robinhood?

Robinhood was the first stock brokerage app that did NOT CHARGE COMMISSIONS.

What that means is that users can open an account with literally just a few dollars and start buying shares without paying any commission with each trade.

The Robinhood app offers a commission-free model that provides users access to trade securities at no cost. Robinhood began exclusively as an i-phone app but then quickly rolled out their Android versions, as well. The app allows users to invest in U.S. stocks, ETFs, options, and cryptocurrencies.

One thing to know is that Robinhood is for the people–That is why there are no account minimums and no fees to trade with Robinhood.

Both features are a rarity in the fintech space. You can trade several all U.S. listed stocks and ETFS. And now you can also trade cryptocurrency and even options. And by the way, if cryptocurrency peaks your interest, check out our review of BlockFi, the best place to earn interest on your cryptocurrency.

Robinhood also offers Robinhood Gold account which is a premium account that allows you to trade on margin. But beginning investors don't need to worry about that or pay for that.

So, what makes Robinhood so popular?

Robinhood is famous for its commission-free trading, easy application process, and intuitive mobile platform. But best of all, they give you a free share of a stock when you open and fund your account!

So How Do I Open a Robinhood Account and Get up to $1,000 in FREE STOCK?

To open a Robinhood account, all you need is your name, address, and email. If you want to fund your account immediately, you will also need your bank account routing and account number.

As its current promotion, Robinhood is giving away a FREE STOCK (valued at $5 to $500) to anyone that opens a new account this month if you click on the promo image below. Then, once you open and fund YOUR account with at least $10, you will receive more free stock (again valued at $5 to $500) for referring your friends and family. The more people you refer, the more you get. Click on this promo below to start your Robinhood account application and get your first stock for free.....

Bonus Tip: Use this link to get a share of stock stock for free (up to $500 value) when you open and fund your account with at least $10: sign up for Robinhood today, you'll get one share of a stock that is valued between $5 and $500. FURTHERMORE, for each friend that you refer, you will receive ANOTHER free share of a stock valued at up to $500. This is perfectly legit and you WILL get more free shares for every friend or family member you refer.

Why do they give away so much free stock? Because they spend their advertising dollars this way instead of buying TV, radio, print, or online ads! They WANT you to refer friends!

All of this is great…

…but…

Is Robinhood Safe to Use?

So, we've told you about what Robinhood is and how it works… but is Robinhood secure?

YES–Robinhood is absolutely safe. Your funds on Robinhood are protected up to $500,000 for securities and $250,000 for cash claims because they are a member of the SIPC. Furthermore, Robinhood is a securities brokerage and as such, securities brokerages are regulated by the Securities and Exchange Commission (SEC). Also, I was one of the first 100,000 to open a brokerage account with Robinhood in 2014. I put in a few $100 dollars and made some trades just to test it out. I wanted to make sure that the stocks were priced correctly and that my orders were executed properly. And yes, my trades were made properly and they were commission free!

After a few months of successful trading, I sold everything and had Robinhood transfer my cash back to my checking account. They did so immediately. No problems. No questions asked. I even emailed them to check out their customer service and I got a reply within 4 hours.

I then transferred the money BACK INTO MY ROBINHOOD ACCOUNT and that is where I now save and invest on a monthly basis. Over the last few years, I have made literally 200+ trades and never had any problems with orders executing or with my fill prices. And yes, Robinhood is commission free!

In addition, the company has several other safety measures in place to protect your money and data. So, how is your MONEY protected?

You can sleep easy, knowing that your money is safe.

As you can image, Robinhood operates under plenty of regulation and protection.

But remember, Robinhood is not subject to the scrutiny as a bank.

The imposed regulations and insurance make Robinhood ABSOLUTELY SAFE TO USE–UP TO $500,000.

More about Their Financial Regulation

Since Robinhood is a securities brokerage firm, the company is regulated by the Securities and Exchange Commission (SEC) just like every brokerage firm.

Furthermore, the app is a voluntary member of the Financial Industry Regulatory Authority (FINRA).

FINRA is a self-regulatory body that many brokerages participate in.

As you may recall, your money in Robinhood is protected by the Securities Investor Protection Corporation (SIPC).

The SIPC protects up to $250,000 for cash claims and $500,000 for securities–so 99% of investors have NOTHING TO WORRY ABOUT.

Marketing to New Investors

Robinhood, because it does NOT charge commission and because it allows users to open an account with as little as $10, has been accused of posing a threat to the new and inexperienced investor.

But Robinhood is EXACTLY what new investors need!

New investors typically don't have a lot of money and they are just getting started. So with Robinhood they can open an account and buy just 1 or 2 shares of their favorite stocks and companies and not lose money paying commissions. You want 1 share of Apple–no problem! You want to buy $100 of Starbucks? No problem. You can do that on Robinhood and not pay commissions.

Because Robinhood started as having ONLY an app and not a web page, they were quickly adopted by new and young investors.

What better way for new and young investors to start learning about the stock market and buying shares of their favorite companies than buy allowing them to buy just 1 share at a time and NOT charge commission. THAT is exactly the encouragement that is needed to get young and new investors to start investing for the long term.

Who doesn't want to own shares of their favorite, high-profile company?

But as a new investor, you may need safety over flash…

…and there are significantly "safer" investments on the market.

The safer options include mutual funds, exchange-traded funds, and bonds.

Robinhood App Features

Robinhood likes when you make trades on their app.

In fact, when you execute trades, the app "celebrates" by throwing virtual confetti at you.

Who isn't a sucker for confetti?

The app also sends you push notifications when there are changes in stock price.

These features are fine but steadily encourage frequent stock trades.

The confetti and notifications can lead investors to believe they are doing something good.

But is that always the case?

Of course not.

Moral of the story: If you don't know what you're doing, don't get excited about the confetti (because everyone gets it).

Robinhood is not the easiest to maintain a diversified portfolio (which is hard to do without mutual funds, in the first place).

The overall lack of diversification poses risks to many investors.

And, finally, Robinhood does not emphasize education as much as other apps.

The company promotes "learning by doing."

Learning by doing is an excellent way to learn but may come at a high price!

The Great Banking Controversy

In addition to the above, Robinhood has not always maintained smooth sailing.

Back in the day, Robinhood announced its plans to launch Robinhood Checking & Savings.

These accounts promised an outstanding 3% interest rate.

According to a Robinhood spokesperson, cash in the accounts was insured by up to $250,000 by SIPC.

But there was one problem…

…the accounts were not FDIC-insured.

The controversy swiftly ended the bank account idea – for now.

However, the legal implications remain and have many investors concerned.

Why?

Because there should be no uncertainty when it comes to regulatory protection.

Could you imagine waking up to the money in your bank account simply gone?

Yes, Robinhood is SIPC-insured, but checking and savings accounts must be FDIC-insured.

From there, Robinhood quickly admitted fault in its ways through the company blog.

The company also announced a re-branding and re-working of the new product.

The new product promised to work closely with regulators and "revamp its marketing materials, including the name."

Regardless, the controversy has many investors on their toes.

Is the company willing to bend the rules to acquire new business and make money?

That question is undoubtedly a legit one, at this point.

However, one may ask…

…if Robinhood is free, how does the company make money?

Furthermore, how would the company rip anyone off?

These questions are all valid.

Pro Tip: if you sign up for Robinhood today, you'll get a free stock (up to $500 value!)

How Does Robinhood Make Money?

It is no secret that Robinhood does not collect fees or commissions on trades.

Why do you think the company is SO popular?

Instead, the company makes money in other ways.

What are these "other" ways?

Glad you asked.

Robinhood makes money on interest, lending, premium accounts, and rebates.

The only bad thing about Robinhood is they do NOT pay interest on your cash.

The most widely-used Robinhood services are the free ones…

…but the app offers Robinhood Gold for $6 per month.

Robinhood Gold gives users access to up to $1,000 of margin.

If you don't know what margin entails, it is essentially "borrowed" money.

That's right – users can invest up to $1,000 more than they have in cash.

According to Robinhood:

"We generate income on cash, such as customers' uninvested cash that isn't swept to our network of program banks. We do this primarily by depositing cash in interest-bearing bank accounts outside of Robinhood Financial."

Finally, Robinhood makes over 40% of revenue from high-frequency trading and payment from order flow.

This is a practice used by many online brokerages.

Robinhood makes money by processing trades with "behind-the-scenes" parties.

These parties provide the other end to the trade.

So, what is the difference?

Robinhood goes through third-parties rather than processing your order through an exchange.

The third parties that Robinhood uses include the "market makers," Citadel Securities, Two Sigma, Wolverine, and Virtu.

If you want the full breakdown on Robinhood's fees, read our article here.

What Stocks Should I Buy?

What Stocks Should I Buy on My Robinhood Account? Beat the Market With This Stock Newsletter

Once you have opened your Robinhood account and you then have to decide which stocks to buy.

Here's some quick advice–don't chase rumors and don't start guessing at stocks.

It's always best to follow the advice of professionals, especially when it comes to investing your hard earned cash.

At WallStreetSurvivor, one of the services we provide is that we help our users find the best stock picks.

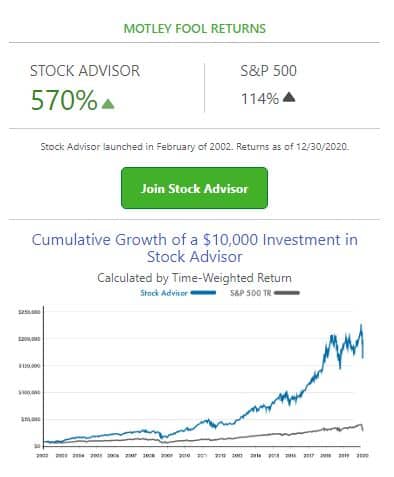

For the last 20 years, we have subscribed to dozens of stock newsletters and tracked their recommendations. We know, without a doubt, which stock newsletter has been the best for the last decade. In fact, we trust this one stock service so much that for the last 5 years we have bought everyone one of this service's stock picks in our real brokerage account.

This stock newsletter has outperformed the market by over 59% each of the last 5 years. In fact, as of January 2, 2021 they were just awarded our AWARD for the BEST STOCK NEWSLETTER OF 2020 because their 21 of their 24 stock picks from 2020 were up and the average return was an amazing 78% which CRUSHED every other newsletter we follow. Since inception, as of December 30, 2020 the AVERAGE return of all of their stock picks is 570%! Click the link below to read our full review.

Follow this link to read our review of the best stock newsletter.

The RISKS You Should Know About Robinhood

Investing with Robinhood is just as safe as investing with Etrade, TD Ameritrade, Schwab or any other US bank.

The question is, do you know how to invest your money? Because if you make bad investments, you will lose your money.

So, what can you do to stay safe?

You need to arm yourself with knowledge.

Otherwise, Robinhood has the infrastructure and regulations in place to keep your money safe.

Oh, and Robinhood will keep your data safe, too.

The risks on Robinhood lie more in "user error" than in the app itself. Just because they don't charge commissions doesn't mean you will make money. You STILL need to pick quality stocks and build a strong portfolio. If you need stock advice, please read ourMotley Fool Review since their stocks picks have been the best over the last 4 years and new subscribers can sign up for just $99 a year.

As the customer, you must always perform your own research on the brokerage, tools, and investments.

Like any other service, Robinhood provides you the platform, but your results depend on YOU.

TAKE ADVANTAGE OF ROBINHOOD'S CURRENT PROMOTION AND OPEN AN ACCOUNT AND CLAIM YOUR FREE STOCK…

After that, you are good to go with Robinhood.

The company is safe, receives high safety ratings, and is safe for investing.

And when it comes to your money, just be sure that Robinhood is right for you.

Ask yourself the following questions:

- What are your objectives?

- How much money can you afford to invest?

- Do you have an emergency fund?

- Do you have debt that must be paid-off?

- Is your retirement plan on track?

If you answered YES to all of these…

…you are ready to get started with Robinhood (or another brokerage).

The Conclusion

Okay, so we spent the last 5-10 minutes of your life telling you all we know about Robinhood.

From what we have seen so far, in the 3 years that we have had an account, Robinhood is SAFE. And, it is probably the best brokerage app for new investors. So if you are thinking of opening a brokerage account with Robinhood you should NOT be worried about whether or not it is safe. You should be thinking what will be the first stock you buy.

With that said, here is the verdict:

ROBINHOOD IS SAFE!

Keep in mind, Robinhood is currently offering you a FREE share (up to $500 value) if you open and fund your account by the end of this month.

Furthermore, Robinhood IS OFFERING YOU ANOTHER $500 IN FREE STOCK, if you refer your friends and they open an account.

So don't hesitate, CLICK HERE to open your account and get your FREE stock.

So How Do I Open a Robinhood Account and Get up to $1,000 in FREE STOCK?

To open a Robinhood account, all you need is your name, address, and email. If you want to fund your account immediately, you will also need your bank account routing and account number.

As its current promotion, Robinhood is giving away a FREE STOCK (valued at $5 to $500) to anyone that opens a new account this month if you click on the promo image below. Then, once you open and fund YOUR account with at least $10, you will receive more free stock (again valued at $5 to $500) for referring your friends and family. The more people you refer, the more you get. Click on this promo below to start your Robinhood account application and get your first stock for free.....

Bonus Tip: Use this link to get a share of stock stock for free (up to $500 value) when you open and fund your account with at least $10: sign up for Robinhood today, you'll get one share of a stock that is valued between $5 and $500. FURTHERMORE, for each friend that you refer, you will receive ANOTHER free share of a stock valued at up to $500. This is perfectly legit and you WILL get more free shares for every friend or family member you refer.

Why do they give away so much free stock? Because they spend their advertising dollars this way instead of buying TV, radio, print, or online ads! They WANT you to refer friends!

Is Robinhood App A Legitimate Stock Trading App

Source: https://www.wallstreetsurvivor.com/is-robinhood-safe/

Posted by: branchligival.blogspot.com

0 Response to "Is Robinhood App A Legitimate Stock Trading App"

Post a Comment